Student loan forgiveness would help everyone, but it wouldn’t help everyone equally. Everyone would benefit a lot, and the people who still owe money would benefit somewhat more than the people who paid off their debts.

Let’s call the people who paid off their debts Vladimir, and the people who still owe are Ivan.

Just to be clear: student loan forgiveness means that Vladimir and Ivan would get all the benefits that the US as a whole would get from the program. Ivan would get the additional benefit of not having to pay back as much money. So, Ivan would benefit more.

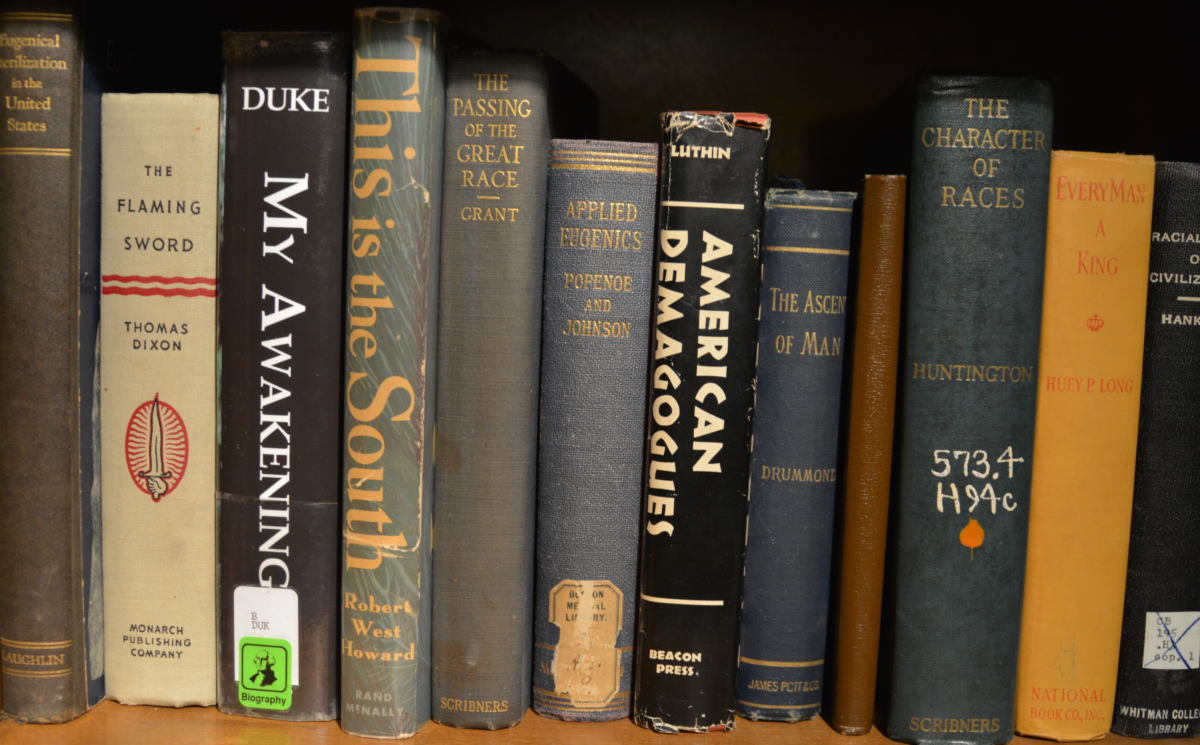

“Vladimir’s Choice” is a Russian folk tale that is used by cognitive pscyhologists to explain why people will often choose not to benefit just in order to make sure an out-group doesn’t also benefit. Vladimir, an impoverished peasant, was one day visited by God, who said, “Vladimir, I will give you anything you want.” While Vladimir was thinking about what he wanted, God said, “But there is one condition. Whatever I give you, I will give twice that to Ivan.” Vladimir thought about it for a while, and then said, “Gouge out one of my eyes.”

There is a classic experiment along these lines. People are broken into two groups, and one group (Vladimir) is given the option of getting ten dollars, in which case five dollars will be given to the other group (Ivan), or getting twenty dollars, in which case fifteen dollars will be given to Ivan.

It’s astonishing the number of people who choose the first option—Vladimir’s Choice. The book Dying of Whiteness has a chapter about people who would materially benefit if Medicaid were expanded to their state (by which I mean they would live longer) but they would rather suffer than allow those same benefits to go to minorities.

There are, I think, some really good objections to student loan forgiveness in terms of disproportionate benefit (some of which are mentioned here and here). These objectons have to do with such a transfer of wealth benefitting people who are already reasonably well off (I think they’re reasonable, and imply some methods of forgiveness are better than others, not that the whole idea is bad). But that isn’t the kind of objection I hear most often—the one I hear is Vladimir’s Choice.

I love this analysis, but I worry that it leaves out a third group — people who elected not to attend college because they decided that they could not afford it. They have no debt paid and no debt to forgive; they have only lost opportunities.

I would rather we reform how we pay for future college than forgive past college debt, so that no one feels like they cannot choose college ever again.

That’s part of the argument in the Brookings article. And it’s worth considering.

I am one of those people; In my thirties I considered getting a degree to help me to get a better paying job, or more accurately to be considered for better paying jobs, but realized I would likely end up paying back loans until just short of retirement age. It might have helped my employment prospects, but probably not enough to offset the cost.

There is a very real sense in which higher education in the USA works as a form of class reproduction, where the children of the bourgeois dutifully attend college and then report for their desk jobs upon graduation. And starting in the 1980s this has become a worse and worse deal, with the necessity of taking out larger and larger loans to secure this education. But the trade-off remains that if you want the desk job, they often won’t even look at your resume if you don’t have a degree, even if it’s in an unrelated field. I have heard hiring managers explain this as “a college degree just shows me that they are willing to commit to something and work at it” or words to that effect. As somebody without a degree, I have naturally always been somewhat skeptical about this assertion. (Obviously there are professions — doctors, for example — where a degree is not just an arbitrary barrier to entry.)

Even if it were true that completing college demonstrates some critical quality for employees, it wouldn’t change the fact that if degrees are a barrier to entry for living-wage careers, and the most likely predictor of college attendance is having parents who went to college, it is a form of class reproduction. Add in a preference for candidates who went to a “good” school and the opportunity for employers to hire members of their own class only increases. (Unpaid internships with an inside track to employment are another common method to allow affluent hiring managers to only hire affluent candidates.)

It has been my experience that this sense of where one belongs in a class hierarchy has a huge bearing on whether or not taking on debt to finance college seems like a worthwhile trade. More affluent people are more likely to assume they will be successful enough in their post-college careers to pay off the debt they incur — they feel they “belong” in the class of people who earn six figures. And this is the gamble several generations have now made, and for more and more of them it looks like they made bad bets.

So here is my dilemma: I support forgiving student loan debt, because I understand it is a debt bubble, and because I think education should be something people can attain without incurring a lifetime of crippling debt. I think everyone should get free college! But if student loans are forgiven and nothing else happens, it looks an awful lot like a handout for the middle class and a kick in the teeth for the poor people who either didn’t or couldn’t finance a college education with loans.

I don’t particularly want to condemn people to penury because they were foolish enough to think a college degree would allow them to rise above the crushing realities of the modern economy. But I am extremely wary of a social safety net that only catches the children of the middle class.

It’s not just that it will be spun by opportunistic populists as “coastal elites (translation: people with college degrees) just used your tax dollars to pay off their debts, but where were they when your truck got repossessed?”

It’s also that they’ll kind of have a point.

Thank you, Sylv — so much better than I put it.

Neither Vladimir nor Ivan — I hope Patricia Roberts-Miller will chime in.